Credit Cards, Debit Cards

There are three main types of cards, credit card, debit card and prepaid card.

1.Credit Card

The banks and a couple of non-banks (or NBFCs) generally issue such cards along with networks(Mastercard, Visa, Amex).

The card issuer creates a account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance.

There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium). There are also co-branded credit cards that are issued by bank for a particular partner company like Flipkart Axis, Amazon ICICI Pay etc.

Following are few feature of Credit Card

- Credit Limit: Customer get credit limit which depend on their salary, profession, company

- Spending Rule: Allow the cardholder to spend up to a specified credit limit

- Credit Period: Offer cardholder an interest fee period, allow card holder to repay at least the minimum amount each month, but charge interest on the unpaid balance

*Note :- We are going deep down to credit card in depth, here just explain what is Credit card

2. Debit Card

These cards are issued by bank along with the card network and the card is linked to the customers bank account. Customer spending is limited to the balance in the account

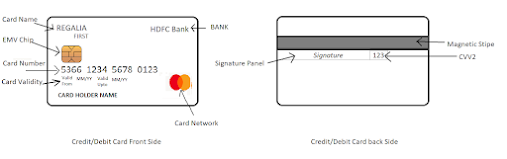

The Standard card look like below

Card contain following

- Card: Card can be virtual or physical. Physical card can be plastic or metal

- Card Name: Usually Specify a program Regalia, Super etc.

- Issuing Bank: Bank that provided the card.

- Card Network: Payment System that define issuance and acceptance framework eg visa, MasterCard

- Card Number: This is the unique number of the card. Length of the card number can vary from 13 to 19 digits depending on the card scheme. Example Visa , MasterCard has 16 digits and Amex has 15 digits

- Expiry Date: Validity of card for using time

- Cardholder Name: Name of the card holder printed on the card. Some time on debit card name is not printed on the card when account is open and instant kit is provided.

- EMV Chip: EMV is a global standard to provide better security through chip-based transaction. EMV stand for Euro Pay, MasterCard, Visa. EMV card chip inserted to POS to process transaction.

- Magnetic Stripe: The stripe behind the card that has encoded card details and can be swiped at POS machine to process transaction

- CVV2/CVC2: Card Verification Value or Card Verification Code is a 3 digit code for MasterCard and Visa Card, 4 digit for Amex Card. For Mastercard and visa it printed in behind of Card, for Amex it printed on front of card

- Signature Panel: The Credit card holder sing on the panel. Previously pin verification was not there merchant verify signature of receipt with card signature to cross-check user

Comments

Post a Comment